This can be useful if you have an income source outside of your job that could leave you with a big tax bill in April. If you think you’ll owe a lot at tax time and would rather increase your paycheck withholding to avoid getting a large bill, you can request an additional dollar amount of withholding on both forms. How You Can Affect Your Maryland Paycheck If your Maryland earnings are subject to income taxes, your employer will withhold that money from your paychecks, at the special nonresident rate of 2.25%. It depends on whether your state of residence has a reciprocal agreement with Maryland, and on the type of income you earn in Maryland. If you’re not a resident of Maryland but you have a Maryland income source, you may or may not owe Maryland taxes. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future. The local tax rate you’ll pay in Maryland is based on where you live, not where you work.Ī financial advisor in Maryland can help you understand how taxes fit into your overall financial goals. You can pay the relevant taxes on your Maryland state income tax return, as there is no separate tax form for county or city income taxes. On top of the state income taxes, Maryland counties and the city of Baltimore charge each their own local income tax. Maryland has a progressive state income tax system with eight tax brackets. In Maryland, your employer will withhold money for your state and local income taxes, too. If you get paid monthly you’ll have to be extra careful that you don’t run out of money before the month is out. That makes it easier to budget your money. The more frequent your paychecks, the smaller they’ll be, assuming your wage or salary is constant.

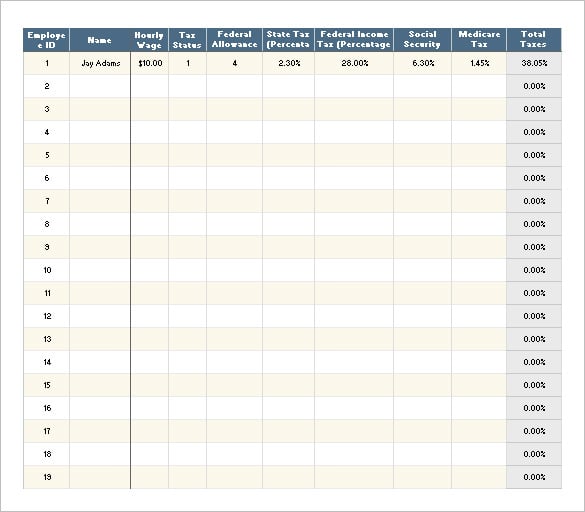

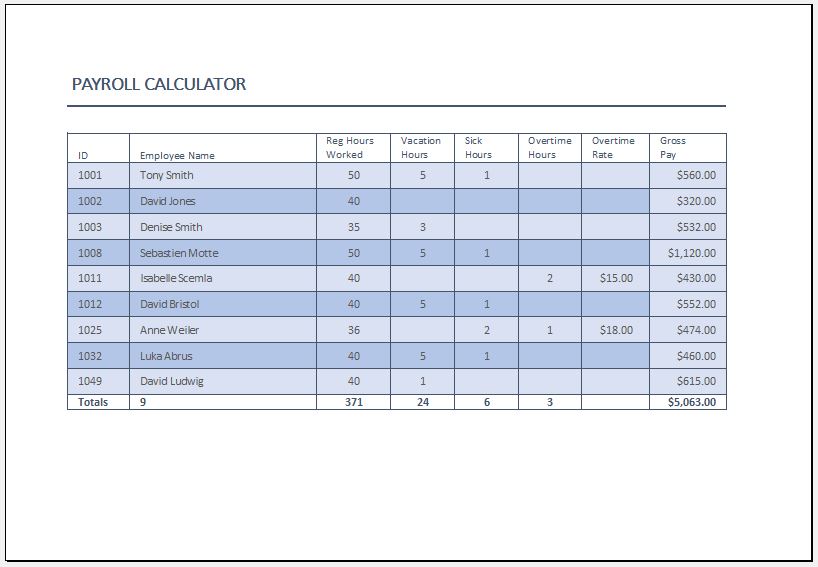

The same goes for contributions to retirement accounts or commuter benefits. If you pay anything for health insurance, life insurance or disability insurance premiums through your employer, you’ll see those monthly contributions taken out of your earnings. The form also uses a five-step process where filers must indicate additional income, enter personal information and claim dependents.įICA taxes and income taxes aren’t the only things that can be taken out of your earnings. Instead, it requires you to enter annual dollar amounts for things such as income tax credits, non-wage income, total annual taxable wages and itemized and other deductions. The Form W-4 has changed in recent years, as it now no longer uses allowances. If you have too little money withheld, you’ll owe the IRS come tax time. If you have too much money withheld from your paychecks, you won’t receive that money during the year, but you’ll have a lower tax bill in April or a sizable refund. This is where you declare your marital status, list additional income or jobs and claim dependents. Just how much your employer withholds from each paycheck depends on the information you provide on your W-4 form. Instead of paying your income taxes all at once in April, you pay in smaller installments throughout the year. Your employer also deducts money from your paycheck to cover your federal income taxes. Earnings above $200,000 are subject to a 0.9% Medicare surtax that your employer does not match. Those contributions help Social Security and Medicare stay afloat. Together, these taxes are called FICA taxes and your employer matches the amount you pay in FICA taxes. Every pay period, 6.2% of your earnings goes toward Social Security taxes and 1.45% goes toward Medicare taxes.

Some of it is withheld for FICA taxes, income taxes and other deductions and contributions. If you look at your pay stubs, you’ll notice that not all of your salary goes into your bank account on payday.

#Paycheck calculator plus

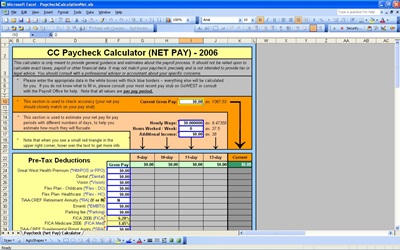

We offer both types of calculators.Įnter a gross pay amount and the Salary Paycheck Calculator estimates net (take-home) pay after taxes and deductions are withheld.Įnter the gross hourly rate and the number of hours worked and the Hourly Paycheck Calculator estimates net pay after taxes and deductions are withheld.Įnter a net pay amount and the Net-to-Gross Paycheck Calculator estimates gross wages before taxes and deductions are withheld. Paycheck calculators typically calculate your net pay (the amount you take home after taxes and deductions are withheld) and your gross pay (the amount you get paid before any taxes or deductions). About Intuit Online Payroll's Paycheck Calculators

0 kommentar(er)

0 kommentar(er)